Top Business Funding Solutions Today

Comprehensive Business Financial Support

When it comes to meeting your unique business funding needs, traditional loans may not always be the ideal solution. At Kingston Finance we invest time in getting to understand your company, taking an objective view, in the way that lenders do, of your commercial dynamics and how they support growth and expansion ambitions.

-

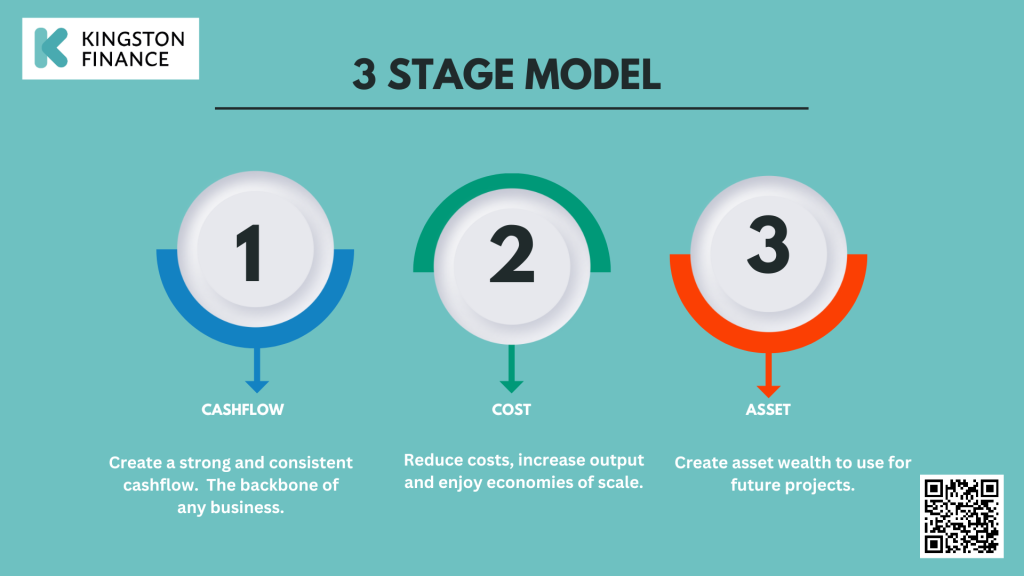

Our unique 3-Stage Model

To help you prepare a business loan funding application, we apply a comprehensive 3-stage model, which optimises cash flow, reduces costs and creates valuable assets. Once we have thoroughly assessed your unique requirements, we then leverage our extensive network of financial solutions. As an independent firm, we have access to an entire global market of lenders. Having done the groundwork with you, we find the most suitable financial solution for your needs, giving lenders a comprehensive and positive overview based on our input and preparation of your business case.

-

Ongoing support as your financial partner

Our support doesn't end with an application. We provide regular workshops and networking events to foster connections and knowledge sharing among our clients and fellow professionals in the business community. These workshops cover essential topics such as lead generation and cultivating a business growth mindset.

Frequently Asked Questions

1. What is business funding?

Business funding refers to the financial support provided to businesses to help them grow, expand, or manage operations. It can come in various forms, such as loans, invoice financing, or asset finance, and is essential for maintaining cash flow and supporting business activities.

2. How does invoice financing work?

Invoice financing allows businesses to borrow money against the amounts due from customers. It helps improve cash flow by providing immediate funds, which can be used for operational expenses or growth opportunities, without waiting for customer payments.

3. What is asset finance?

Asset finance is a type of funding that allows businesses to acquire or lease assets like equipment, vehicles, or machinery. It helps preserve working capital and provides flexibility in managing business resources, enabling companies to invest in essential assets without large upfront costs.

Move your business to the next level

Answer a few questions about your business financials and discover how to take your business to the next level.